A Strategic Move to Balance Power in the Rolex Watch Industry

In the immediate aftermath of Rolex’s proposed acquisition of Bucherer, reactions have largely fallen into two distinct camps.

One group of executives in the watch trade believes there will be little to no change for Rolex, Bucherer, the numerous Rolex official retail partners, or consumers, at least in the short- to medium-term, roughly spanning the next five years.

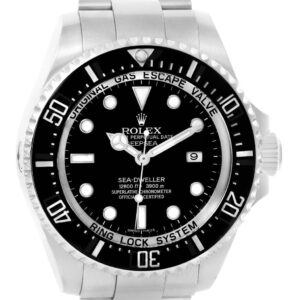

Another group anticipates that it will only be a matter of time before Rolex and Bucherer capitalize on the advantages of a fully vertically integrated company, from the manufacture of components and finished replica watches to retail and after-sales service.

However, I propose a third possible outcome: that Rolex is strategically aiming to limit the power of major retail chains and shift its support towards the most successful family-owned independent retailers.

Historically, Rolex has always maintained strict control over its authorized dealers, possessing the power to either restrict or facilitate their expansion plans. Acquisitions involving other Rolex retailers (and similarly for Patek Philippe partners) are far less likely to proceed unless these powerful brands give their approval. Investing millions in new or expanded showrooms is equally improbable without assurances from these brands that they will be represented in the stores, along with promises of sufficient watch allocations to justify the costs.

So, what message might Rolex be sending with the acquisition of Bucherer?

First, it is apparent that two historic Swiss businesses prefer to remain under Swiss ownership. This is one reason why the Watches of Switzerland Group would have found it challenging to acquire Bucherer (assuming they were ever in the running), and why a private equity takeover never gained traction.

Additionally, by acquiring Bucherer, Rolex immediately gains the ability to control Bucherer’s future growth entirely while maintaining strong influence over the Watches of Switzerland Group’s expansion plans.

My hypothesis is that Rolex is satisfied with the current size of both major retail chains across Europe and the United States, at least in terms of their allocations and number of retail outlets. Rolex has always aimed for a balance between large retail chains and family-owned independents, and it appears that it now wants to strengthen its support for independent retailers.

This trend is particularly evident in the United States, where independent retailers are investing significant amounts of money into substantial upgrades. Numerous projects have been announced in recent months:

In California, Geary’s in Beverly Hills and Polacheck Jewelers in Calabasas are building large new Rolex and Patek Philippe showrooms.

Hing Wa Lee is investing $15 million in its third Rolex-anchored megastore in Los Angeles.

London Jewelers completed side-by-side Rolex and Patek Philippe points of sale in New Jersey.

Long’s Jewelers in Boston finished a two-story Rolex showroom last year and is building another suburban multibrand store anchored by The Crown.

Alson Jewelers in Cleveland recently broke ground on an 11,000 square foot building to provide a significantly expanded space for Rolex.

Ben Bridge relocated its historic Seattle flagship to give more space to Rolex in a new showroom.

Hamra in Scottsdale, Arizona, is moving its flagship across the street to create more space for replica Rolex and Patek Philippe at https://www.replicaimitation.com.

Meanwhile, Bucherer in the United States is investing millions in upgrading and converting older Tourneau stores into Bucherer-branded showrooms but is reducing the number of stores, not expanding its network. The Watches of Switzerland Group continues to expand in the USA, UK, and Continental Europe, but most of its capital expenditure is going into new monobrand stores for brands like Tudor, Omega, Breitling, and TAG Heuer, in addition to enhancing the showroom experience across Goldsmiths, Mappin & Webb, and Mayors in Florida.

The evidence may be circumstantial, but this trend is worth monitoring in the coming years. Will companies like Bucherer and the Watches of Switzerland Group (and perhaps Hour Glass in Singapore or Ahmed Seddiqi & Sons in the United Arab Emirates) be allowed to continue growing their Rolex businesses, or will independent retailers be prioritized and incentivized to expand more rapidly with the brand?